Drink Driver Van Insurance

- Specialist insurance for drivers with drink driving convictions

- All drink driving related offences considered.

- Discounts for drivers who complete a rehabilitation course.

Trusted By Thousands Of Drivers

Drink Driving Conviction? Don’t Stress, We’ve got You covered.

Var Insurance For Drink Drivers

Searching for drink driving insurance can be a challenge when you have a conviction. Some insurers may refuse to offer you insurance or want to charge you more. At A Choice, we consider all motoring convictions and bans. We treat our customers fairly, as individuals and with no judgment.

We work with a panel of specialist insurers to find car insurance for drink drivers. So, if you’re looking to get back on the road after a conviction, we could help

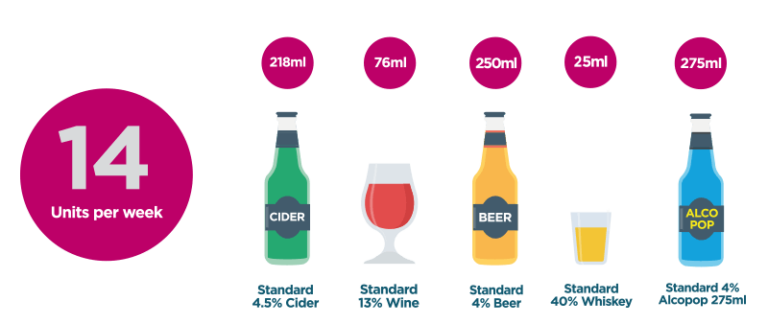

What Does 1 Unit Of Alcohol Look Like?

Do I Have To Declare a Drink Driving Conviction?

Past convictions that are classed as ‘unspent’ must be disclosed if asked by the insurer. This also includes anyone added to a policy, such as a named driver. This is because the severity of the conviction may affect the cost or availability of a policy. Failure to disclose an unspent conviction when asked by the insurer, could invalidate your insurance. Also, any claims you make on your policy may be rejected. Under the Rehabilitation of Offenders Act 1974, if a conviction is ‘spent’, you do not have to disclose it when applying for insurance. If they are provided, then the insurer is legally required to ignore them. If you are unsure whether a previous conviction is spent, see disclosurecalculator.org.uk or contact Unlock’s public helplineDrink Driving Convictions That We Can Consider

Drivers commonly seek DR10 insurance for drink driving offences. However, we will consider all drink driving related offences. The table below shows the full list of drink related motoring offences that can be put on your driving licence if you commit a traffic offence. It also shows how many penalty points you can get from each.

Codes DR10 TO DR61 must stay on a driving record for 11 years from the date of conviction.

| Code | Offence | Penalty Points |

|---|---|---|

| DR10 | Driving or attempting to drive with alcohol concentration above limit | 3 to 11 |

| DR20 | Driving or attempting to drive when unfit through drink | 3 to 11 |

| DR30 | Driving or attempting to drive then failing to provide a specimen | 3 to 11 |

| DR31 | Driving or attempting to drive then refusing to give permission for analysis of a blood sample that was taken without consent due to incapacity | 3 to 11 |

| DR61 | Refusing to give permission for analysis of a blood sample that was taken without consent due to incapacity in circumstances other than driving or attempting to drive | 10 |

Codes DR40 to DR70 must stay on a driving record for 4 years from the date of the offence or 4 years from date of conviction where a disqualification is imposed.

| Code | Offence | Penalty Points |

|---|---|---|

| DR40 | In charge of a vehicle while alcohol level above limit | 10 |

| DR50 | In charge of a vehicle while unfit through drink | 10 |

| DR60 | Failure to provide a specimen for analysis in circumstances other than driving or attempting to drive | 10 |

| DR70 | Failing to provide specimen for breath test | 4 |

Frequently Asked Questions

Don’t feel disheartened after a drink driving conviction, there are still several things you can do which can help reduce the cost of van insurance.

As part of your drink driving conviction, you may be given the option to take a drink driving course, although you will have to pay for the cost of the course, which can cost up to £250. Our insurance panel can also offer discounts for drivers who complete the course.

Keep your van in a secure location such as a garage or a driveway when not in use. This is generally safer than leaving the vehicle on the road and can help to lower your insurance premiums.

Choosing to pay a higher voluntary excess can reduce the cost of insurance. However, if you do make a claim, you will have to pay the excess, so it is important that you choose an excess amount that you can afford to pay.

Fit a security device, such as an alarm, immobiliser or tracker to your vehicle. This means it is less likely to be broken into or stolen. As a result, insurers are more likely to offer you a cheaper van insurance quote.

Insurers will put all vans into one of 50 insurance groups, with van in the lower insurance groups being cheaper to insure.

Adding an experienced, responsible driver to your van insurance policy may help to reduce the cost of your premium.

Drink Driving Limits

The maximum BAC (blood alcohol content) limit in England, Wales and Northern Ireland is:

- 35 micrograms of alcohol per 100 millilitres of breath; or

- 80 milligrams of alcohol per 100 millilitres of blood or

- 107 milligrams of alcohol per 100 millilitres of urine

The maximum BAC (blood alcohol content) limit in Scotland is:

- 22 micrograms of alcohol per 100 millilitres of breath; or

- 50 milligrams of alcohol per 100 millilitres of blood or

- 67 milligrams of alcohol per 100 millilitres of urine

More Information

If you’re looking to get back on the road after a drink driving offence, contact our team as we may be able to help. Otherwise, if you would like further information, advice and support, see Unlock, an independent charity that helps people with convictions. Also see Drink Driving forum.